Founder Advisor

Standard Template (FAST) 2025

About Skala FAST (2025)

Advisors are mission critical for early‑stage startups. To help founders bring them on board quickly, the Founder Institute released the Founder / Advisor Standard Template (FAST) in 2011 and updated it in 2017.

The original FAST is still a solid starting point, but there was room to make the advisor relationship easier to set up and manage. Our 2025 Skala FAST does exactly that.

Below are the details behind each change.

Flexible Advisor Commitment

The parties can set any number of hours the advisor will devote to the company. As a reference point, the original FAST suggests 5 to 20 hours per month.

Variety of Advisor Compensation

The original FAST, like many law‑firm templates, covers equity only. Today founders often combine equity with cash or even tokens, especially in crypto projects.

Our template lets the parties mix and match stock options, restricted stock, cash, and tokens in any combination. That single improvement removes the need to juggle several separate documents.

Flexibility in Equity Compensation

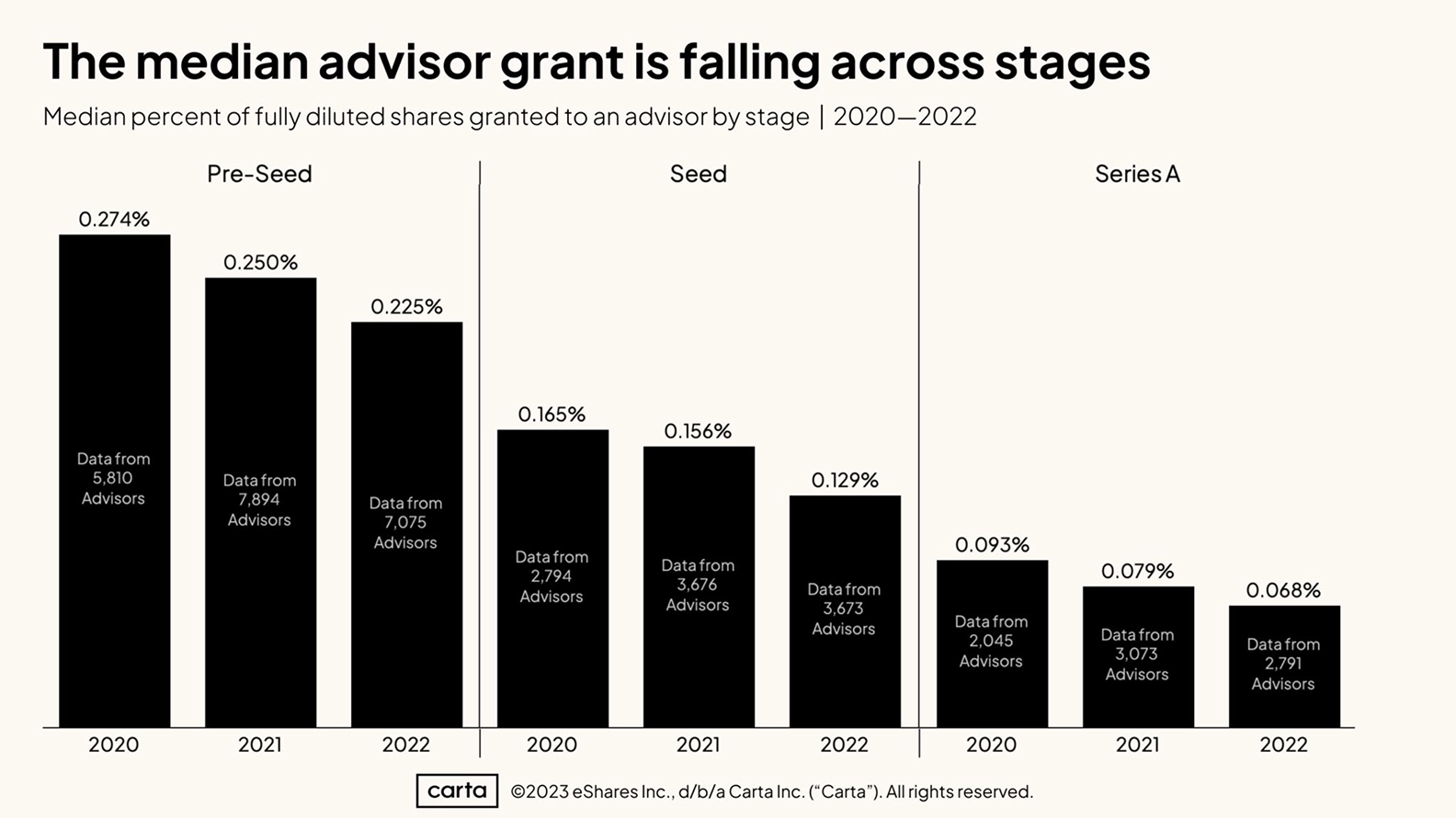

Startup valuations have climbed and the role of advisors has evolved, leading to smaller equity grants. Carta data confirms the downward trend.

The new FAST lets the parties choose any equity amount they consider fair, rather than locking them into ranges that could soon be outdated.

Clarity in Equity Compensation

Many advisor templates fail to state the exact number and percentage of shares the advisor will receive, which causes trouble during due diligence and breeds false expectations. A precise share count is also required if the advisor wants to file an 83(b) Election and lock in today’s valuation for tax purposes.

Our template fixes both issues by spelling out the exact number and percentage of shares. Skala can also guide advisors through the 83(b) Election filing process.

Definitive Agreements

FAST is a great starting point, but not a sign‑and‑forget document. The parties still need the definitive agreements that actually issue the equity or tokens:

Options: Equity incentive plan and corporate approvals (coming soon on Skala)

Restricted stock: Restricted Stock Purchase Agreement and board approvals (available on Skala)

Cash only: No further agreements needed

Tokens: Token Grant Agreement (available on Skala)

Governing Law

This template is designed to work under the applicable laws of the U.S. However, parties may choose any major jurisdiction as the applicable law, including the United Kingdom, Singapore, or UAE.

While we can’t guarantee enforceability in every country, the template is designed to hold up under the laws of major legal systems. It’s generally recommended to choose the law of the jurisdiction most closely connected to the parties’ shared business.

Dispute Resolution

We couldn't settle on a single default mechanism for dispute resolution, so we left the choice to the parties: arbitration or state court litigation. Arbitration provides privacy and can be more efficient, but it's typically more expensive. To balance this, our template requires the losing party to cover all arbitration costs.

State court litigation, on the other hand, is generally simpler and more cost-effective, making it a popular choice for many businesses, though it lacks the confidentiality of arbitration.

One document. Countless deals.

FAQ

The exercise price of the shares under the FAST agreement will be determined at the time of issuance and will be included in the applicable Stock Purchase Agreement.

-

-

-

-

-

FAQ

According to Carta’s equity benchmarks for advisors, early-stage startups (pre-seed and seed) typically grant advisors around 0.2% equity on average, with only about 10% of advisors receiving 1% or more in those stages. Equity grants commonly use monthly vesting over two years, sometimes with a three-month cliff, although many companies prefer no cliff or shorter terms because advisor contributions often take place early in the relationship.

Equity or token grants should always be documented in both FAST and a separate grant agreement — Restricted Stock Purchase Agreement or Stock Option Agreement for equity, and a Token Grant Agreement for tokens. These must be approved by the board of directors and clearly recorded in the company’s cap table or token allocation records.

A stock option gives the advisor the right to buy shares later at a predetermined price. The advisor does not own the shares until they exercise the option and pay for them, which can delay both ownership and tax obligations. This is often used by later-stage companies or when the company prefers not to issue shares immediately.

A restricted stock purchase means the advisor buys the shares upfront, often for a nominal amount in an early-stage company. The shares usually vest over time, and the advisor can file an 83(b) election to pay taxes based on today’s low value. This is generally more tax‑efficient at very early stages, while options are more common for later-stage or higher‑valuation companies.

All intellectual property created by the advisor in connection with the engagement is assigned to the company. The advisor is also required to keep all company information confidential, including trade secrets, business plans, and financial data.

Unlike equity, tokens derive their value from ecosystem utility rather than company ownership, providing startups with more flexibility in structuring incentives.

Token-based compensation offers several advantages:

- Preserves Equity: Startups using tokens retain more equity across funding rounds compared to those relying solely on equity grants. This allows founders to maintain greater control while keeping more shares available for future investors or key hires.

- Performance-Based Vesting: Tokens can be structured with milestone-based vesting (e.g., a percentage released upon product launch or user growth milestones), ensuring that advisors are rewarded based on measurable contributions rather than time alone.

- Liquidity: Unlike traditional startup equity, which typically requires an IPO or acquisition for liquidity, tokens can be traded on exchanges, allowing advisors to realize value sooner.