Why Your US Company Might Become Inactive and How to Prevent It

If your U.S. company is marked as inactive, it doesn’t necessarily mean the business no longer exists. But it does mean there are unresolved legal or tax obligations that need addressing. Inactivity can lead to penalties, loss of good standing, administrative dissolution, and problems reopening or closing the company later. In this article, we explain what inactive status means, how it happens, how to fix it, and how to formally close a company you’re no longer using.

What Is an Inactive Company in the U.S.?

An inactive company in the United States is not just a business that has stopped operating: it is a company that has lost legal or tax good standing due to failure to meet its obligations. Even if the company has no clients, no revenue, or no physical presence, it is still required to comply with administrative and fiscal rules on both the state and federal levels.

Once these obligations are neglected, the company may be designated as “delinquent,” “forfeited,” or “administratively dissolved” by the Secretary of State or tax authorities. This change in status limits the company’s ability to operate legally or transact in the U.S.

Why a Company May Become Inactive

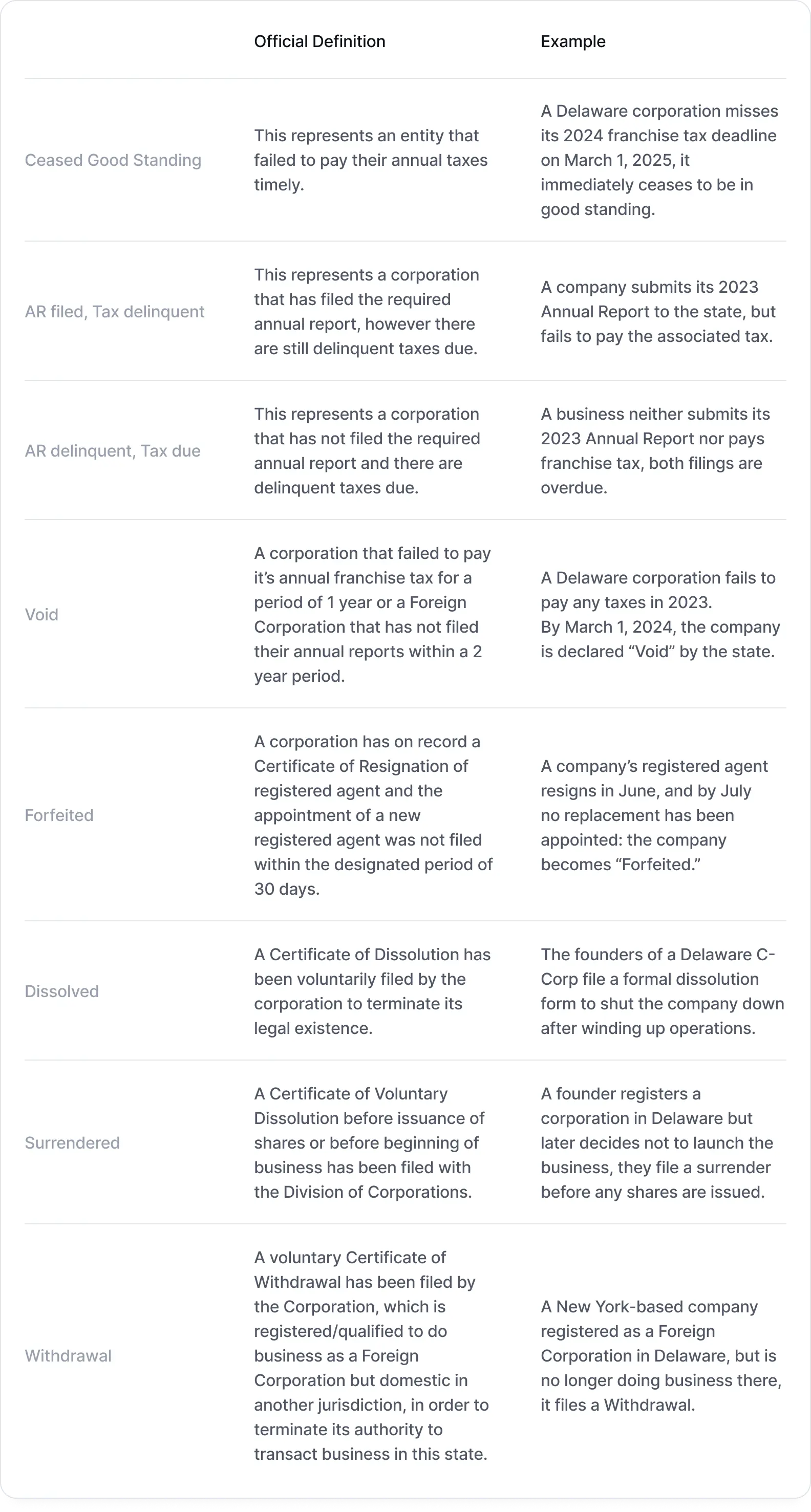

In the U.S., a company becomes “inactive” when it fails to meet legal or administrative obligations at the state level. But the state’s terminology for inactivity can vary, and each status means something slightly different.

Common Inactive U.S. Company Statuses and What They Mean

In our practice, the main triggers are:

- Missed filings or unpaid taxes (leading to AR delinquent, Tax due, or Void);

- Unpaid franchise taxes (causing Ceased Good Standing or Void);

- Loss of a registered agent (Forfeited status).

What Happens When a Company Is Inactive

Once a company is marked inactive, several consequences follow:

- The company loses good standing in its state of formation.

- It may be administratively dissolved and removed from the state’s registry. In most states, once a company is dissolved, its name becomes available for use by other businesses.

- It becomes ineligible for banking, fundraising, licensing, or contractual obligations.

- Penalties and interest continue to accumulate on unpaid fees or taxes.

- Reinstatement becomes more difficult and costly the longer inactivity continues.

How to Restore an Inactive Company

Bringing an inactive company back to good standing is possible, but it typically requires a multi-step reinstatement process. The steps below may vary slightly depending on the state. The specific process may vary depending on why your company became inactive.

Appoint or Renew Your Registered Agent

If your previous registered agent has resigned, you must first appoint a new registered agent and update the company’s official records with the Secretary of State. Some states allow this to be done online; others require a paper form. Without a valid registered agent, you cannot proceed with reinstatement or file compliance documents.

Pay All Outstanding Taxes And File Overdue Reports

Next, you’ll need to catch up on all missing filings and pay any outstanding franchise taxes, penalties, and interest. This may include:

- Annual reports or statements of information;

- State franchise taxes;

- Federal tax returns (including zero-activity returns, if applicable).

Some states automatically calculate late fees and will require payment before processing any reinstatement.

File a Certificate of Reinstatement (or Equivalent)

Once compliance is restored and all outstanding balances are paid, you’ll need to submit a reinstatement form, often called a Certificate of Reinstatement, Application for Revival, or similar.

This document is filed with the Secretary of State and, once accepted, returns the company to active status. In many states, reinstatement is retroactive, meaning it restores your company’s legal existence as if it had never lapsed, which can be essential for contractual or tax continuity.

What If You Don’t Want to Restore the Company?

If you’ve forgotten about the company or simply don’t need it anymore, it still must be formally closed. Many founders assume a company disappears on its own if it’s unused, but that’s not true in the U.S. legal system.

Even if inactive, the company may continue to generate obligations and unless it’s dissolved properly so the fees, penalties, and legal risks may continue to accrue.

Can You Dissolve an Inactive Company Immediately?

In most cases, no. If a company has already been marked as forfeited or dissolved by the state, you may first need to reinstate it (at least temporarily) before filing a proper dissolution request. This is because most states do not allow entities in bad standing to dissolve voluntarily.

The Process for Closing an Abandoned Company:

- Check the company’s legal status on the state business registry website.

- Appoint a registered agent, if none is currently listed.

- Pay past-due state fees and file outstanding documents.

- File for reinstatement, if required.

- Submit official Articles or Certificate of Dissolution.

- File a final federal tax return and notify the IRS that the entity is being closed.

Only after this process is complete can you consider the company officially terminated.

Final Thoughts

It’s easy to forget that U.S. companies require ongoing maintenance, especially if they were set up for a project that never launched. But inactive status is not harmless: it leads to growing legal, financial, and reputational risks over time.

If you want to restore your company, act quickly: appoint a registered agent, pay overdue taxes, and file a certificate of reinstatement in the state of formation. If you want to close the company, make sure to handle the administrative steps correctly, even if the company has been inactive for years. Taking action now, whether to revive or dissolve, will help you avoid unnecessary complications later.